China’s cabinet moved to scrap a rule that caps lending by commercial banks at 75 percent of their deposits, a measure that will help boost credit expansion as the nation looks to revive economic growth.

The State Council will propose amending the nation’s banking law to make the limit a ratio used for reference rather than a regulatory statute, according to a statement posted to its website Wednesday. A system will be set up to monitor the liquidity of banks based on the ratio, it added. Changes to the law need to be approved by the Standing Committee of the National People’s Congress.

Premier Li Keqiang is trying to reshape a state-run banking industry that has $29 trillion of assets, almost twice the amount of its U.S. counterpart. Deregulating interest rates and easing regulatory controls are part of his efforts to support long-term growth by giving markets a bigger role in the economy.

“China’s move to scrap the loan-to-deposit ratio is targeted at mid-to-small-sized banks and will benefit them the most,” said Liu Dongliang, Shanghai-based senior analyst at China Merchants Bank. “The new policy will further stimulate the nation’s credit lending and is bullish for banking stocks.”

China’s stock-index futures rose after the plan to ease lending curbs was announced, jumping 1.5 percent. The Shanghai Composite equities benchmark has advanced 4.7 percent this week.

Lending Constraint

The shake-up is coming five years after the nation completed the stock market listings of the last of its dominant big four banks, which include Industrial & Commercial Bank of China Ltd. The law limiting lending to 75 percent of deposits has been in place since 1995.

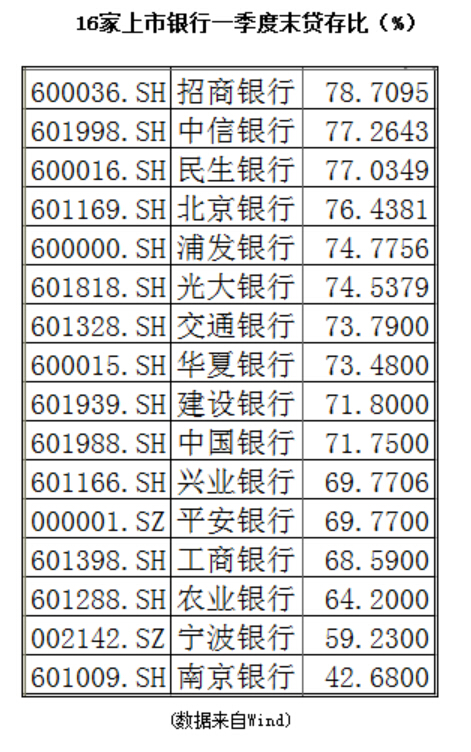

While the loan-to-deposit level for the industry was 66 percent in March, and the China Banking Regulatory Commission eased the requirement last year by changing the method of calculation, it remains a constraint for some listed lenders. Bank of Communications Co.’s ratio was about 74 percent in March, while China Construction Bank Corp.’s was 72 percent.

Wu Xiaoling, a former central bank deputy governor, has argued that the ratio and state-imposed quotas for lending have undermined banks’ abilities to manage their assets and liabilities, and led to distortions such as the use of illegally obtained deposits to boost lending.

In November, Premier Li said that the government would make the ratio more flexible, while the banking regulator said it was seeking to revise the banking law. The central bank has sought to ease some of the stresses in the financial system with three cuts to the benchmark interest rate since November and two reductions in lenders’ reserve requirements this year.

“Banks’ credit lending growth is expected to accelerate with the help of the move to scrap the loan-to-deposit ratio,” said Xu Gao, chief economist at Everbright Securities Co. in Beijing. “But we need to bear in mind that there is a bigger obstacle, which is sluggish financing demand from the real economy. We need to wait and see how much impact this move will have.”

-----------------------------------

Loan to deposit ratio now for 16 national wide commercial banks:

Very nice move. This ratio means, in the past, a bank with £¤1 million deposit liability can only give loans to the market £¤750,000, now the rule is gone. As I said, China's commercial banking industry is bearing too much deposit burden. More than 80% net profits of commercial banking industry comes from net interest margin, which means they have to keep on giving out more loans to companies, and following this logic, banks have to make their liabilities(deposit) bigger to be qualified to issue more loans to make profits.

Good news to banks, government is encouraging more start ups and try to reduce their financing burden, but now the problem is, economy is on a recession, many customers of banks have credit default, the real need of loan is limited as comparing to the past. I bet there will be another round of RRR reduction before the end of this year until the economy is getting better.

http://defence.pk/threads/china-moves-to-scrap-rule-limiting-bank-loans-to-75-of-deposits.382633/ |